New Final Rule Overtime Law – Are You Ready?

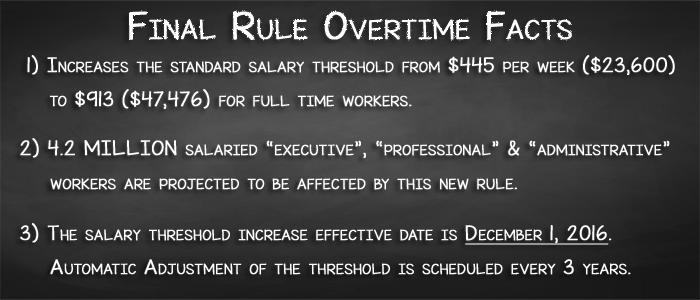

In 2014, President Obama directed the Secretary of Labor to update the overtime regulations to reflect the original intent of the Fair Labor Standards Act (FLSA), and to simplify and modernize the rules so they’re easier for workers and businesses to understand and apply. On December 1, 2016 this new federal rule goes into effect that will change how salaried employees receive overtime.

The Final Rule Regulations

The Final Rule increases the salary level required for exemption to ensure that the FLSA’s intended overtime protections are fully implemented, and to simplify the identification of overtime-protected employees, thus making the “white collar” exemption easier for employers and workers to understand and apply. Without intervening action by their employers, it extends the right to overtime pay to an estimated 4.2 million workers who are currently exempt. It also strengthens existing overtime protections for 5.7 million additional white collar salaried workers and 3.2 million salaried blue collar workers whose entitlement to overtime pay will no longer rely on the application of the duties test.1 Specifically, the Final Rule:

Additionally, the Final Rule amends the salary basis test to allow employers to use non-discretionary bonuses and incentive payments (including commissions) to satisfy up to 10 percent of the new standard salary level.